Renowned hedge-fund manager and distinguished financial author, George Soros, successfully managed to compile a series of articles and essays that he had written in previous times and interlinked them to pursue and conclude on the topic, Financial Turmoil in Europe and the United States. In this book, he seeks to elaborate how economic situations are not only limited to market forces but also by policies that are pursued or not by global leaders. With his expertise in philosophy, political analysis and finance, the author demonstrates the activities leading up to, during and following the financial crisis of 2008-2009.

During then, the period witnessed cheap credit being facilitated and a general lax in lending. It became very cheap for almost everybody to borrow beyond their means to finance housing projects, with federal reserve’s lending rates declining from 6.5% to 1.5%. In so doing, it became easy to access capital. Financial institutions repackaged these mortgage loans into collateralized debt obligations and sold them to investors. Unfortunately, when interest rates rose in the subsequent years, borrowers could not afford to repay these loans, leading to about 500 banks filing for bankruptcy till the US government created the National Economic Stabilization Act of 2008, which saw the creation of $700b pool to buy distressed assets. Other governments around the world formed their own bailout packages, but the effects and distress were felt equally in other countries.

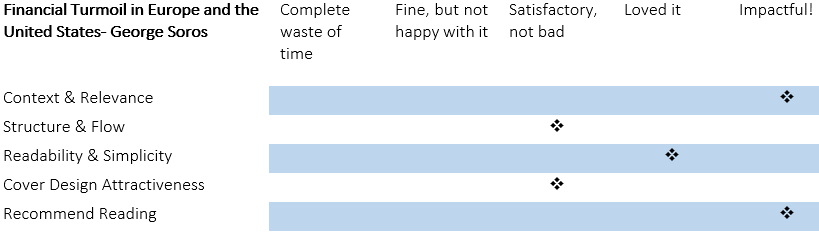

Structured in 4 chapters revolving around different events such as the collapse of the Lehman Brothers, the evolution from the financial crisis to euro crisis and the debate over the bailout package structure, the author necessitates the need for the U.S to restrategize its financial system, to lessen impacts into other countries like those in Europe, due to globalization and interconnectivity, in times of crisis and perilous events. Such arguments are ideally relatable when we think about the Russia-Ukraine tensions, and how other countries are affected by the outcome. In Kenya, the banking system was a tad affected then by the crisis, imaginably because it depended mostly on domestic not foreign deposits. The NSE 20-Share index had, albeit, fallen to a near seven-year low. The impact of this crisis ultimately led to financial institutions in Kenya recognizing the importance of credibility, adopting adequate reserves and sound debt management practices. The CBK became proactive in bank supervision and regulation and imposed sound macroeconomic policies in response to the various predicaments that Kenya was subjected to.

The book gives a very interesting perspective when it comes to financial systems in different countries and the government support granted. In Kenya for instance, the approach that the government takes is that it almost effortlessly bails out players in the agriculture sector, case in point Mumias Sugar company and players in the aviation sector (KQ). There is not much support by the government into the financial industry unlike in the U.S or in the Europe markets. This book is saturated with informative insights, essential and paramount in economic responses, should they eventually occur. With the uncertainty events among the EU member countries, the book should ideally be a reference point in decision making and strategy reevaluation. The book is coherent, interesting and simplified enough for anyone to comprehend.