On September 1st, 2015, the newly elected president of the African Development Bank Group, Dr Akinwumi A. Adesina delineated a new agenda for the Group, building up on the already existing 2013-2022 strategy, to further promote development and growth initiatives within the continent. He proceeded to outline five high development priorities that the Group would focus on; to light up and power Africa, to industrialize Africa, to feed Africa, to integrate Africa and to improve the quality of life for the people of Africa. One of the main avenues that Africa would benefit from this development blueprint, he articulated, was through industrialization. Granted, Africa is fortunate to have abundant natural resources, young and vibrant labour force and fast-growing internal markets, that have in retrospect, simultaneously fuelled post-colonial growth and innovation within the regional blocks. Dr. Akinwumi further ideated the strategy, borrowing from the Sustainable Development Goals and the African Union’s 2011 Action Plan, to lay basis for the development of an index, comprehensive yet understandable enough, that offers insights and knowledge on how African countries measure up in terms of industrialization. Launched in November 2022, the African Industrialization Index (AII) aims at strengthening the knowledge behind the drivers of industrial development. The index covers 52 out of 54 African countries and gives an overview of the continent’s industrialization progress.

The Africa Industrialization Index Methodology

Tailored to fit the African Development Bank’s vision of industrial development for the continent, the index intends to act as a transformative agenda that substitutes the prolonged characteristic of Africa as an agrarian economy towards one based on mass manufacturing. Admittedly, unprecedented shocks such as the COVID-19 pandemic, the Russia-Ukraine war and, climate change, have exposed our vulnerabilities and inefficiencies to satisfy the responsive demand and supply dynamics. That being said, the Index cumulatively provides a critical diagnosis of both public and private sector, and their respective shortcomings through a tripartite frame namely; performance dimension, direct determinants and indirect determinants. The performance dimension assesses a country’s capacity to produce, and export manufactured goods. The performance dimension assesses the value of manufacturing exports, manufacturing value added as a share of GDP and total goods exports and the manufacturing value added per capita. The direct determinants/contributors look at a country’s capacity to generate capital investment, i.e., the attraction of foreign direct investments and the workforce in the manufacturing sector. This dimension is crucial as it demonstrates the importance of investments (plants, machinery, and equipment) and external outputs (assets, electricity, and skilled labour force) towards production. Finally, the indirect determinants measure a country’s readiness to industrialization through considering the business environment and macroeconomic stability. It gauges if governments can effectively facilitate industrial development through implementation of macroeconomic policies, law, security, and infrastructure developments. Through these three dimensions, the Africa Industrialization Index analyses collected data, structures the findings and classifies African countries’ scores by quantile (top, upper-middle, middle, lower-middle and bottom ranks). Data from the three dimensions intends to help African countries identify their strengths and weaknesses, as well as opportunities, across the entire industrialization process.

Findings

From a general perspective, most countries have made gradual progress in industrial development over the period 2010-2021. The Index demonstrates that 25 countries out of the 52 stands above the aggregated average and an overall improvement of the score from 0.5 in 2010 to 0.53 in 2021. The performance index score was the lowest among the three dimensions, with an average of 0.42, further demonstrating that the main concern of Africa’s industrialization is its manufacturing competitiveness. The direct and indirect contributors scored 0.66 and 0.60 respectively, based on a 0 to 1 scale where 0 represents gross underdevelopment of the metric and 1 represents positive developments of the metric. It is seemingly quite the challenge to produce and export manufactured products that have enhanced value-addition, however South Africa, Morocco and Egypt sets the pace in this. Direct determinants emerge as the component on which most of member countries scores the highest. 29 countries rank above the average in the direct determinants while 24 countries rank above the average for indirect contributors. In the three dimensions, South Africa and Morocco seem to have an upper hand however both countries alternate in ranking. Whilst South Africa leads in the performance and indirect dimensions, Morocco leads in the direct contributors.

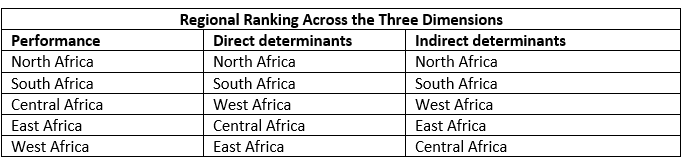

Substantially, countries in the Northern part of the continent outshines in all the three dimensions with Morocco, Tunisia and Egypt consequently in the top 10 performers. Collectively, these results reflect on the rewarding efforts to promote development of industrialization. The Northern region is characterized by industries in chemical processing, automotive and fertilizers. Second in que is countries in Southern Africa. The high performing countries are South Africa, eSwatini and Namibia, which promote industrialization from mining activities. West African and Central African countries are narrowly competing in the performance and direct/indirect dimensions. Senegal and Nigeria are amongst the top 10 performers, owing to their heavy investment in reviving their economies while Central African Republic, the DRC and Chad are characterized by resource richness, however, they fall short due to conflict and instability. Countries in Eastern Africa rank the last despite advantages brought about by substantial investment in infrastructure, trade and digitalization in Mauritius, Kenya, Ethiopia and Tanzania.

Whilst we have analysed both the continental and regional performance, it is paramount to note that Kenya as a country ranks number 9 across all the dimensions. In assessing each dimension however, Kenya performs best in the indirect contributors dimension as compared to the other two. This suggests that attention needs to be given to the performance and direct determinants dimensions in order for Kenya to become an attractive manufacturing centre.

Drawbacks and challenges

One of the challenges observed in the formulation of this index was the availability of quality data, especially on the number of industrial establishments, the share of FDI going to the manufacturing sector and variables on innovation and disbursements of finances from the financial system to the manufacturing sector. The Bank observes that the collection of quality, exhaustive, relevant data, and the subsequent capacity building of country officials in member countries will help solidify insights on performance going forward.

Dr. Akinwumi’s vision for an industrialized Africa is well thought out. However, in order to actualize it, African nations need to rally behind Sir Churchill’s mantra that continuous effort and not strength and intelligence is the key to unlocking potential. The second part of this series carefully and pragmatically discusses what measures Kenya can undertake for full recovery of its lost glory and overcoming its operational deficiencies to promote the overall industrialization initiative.